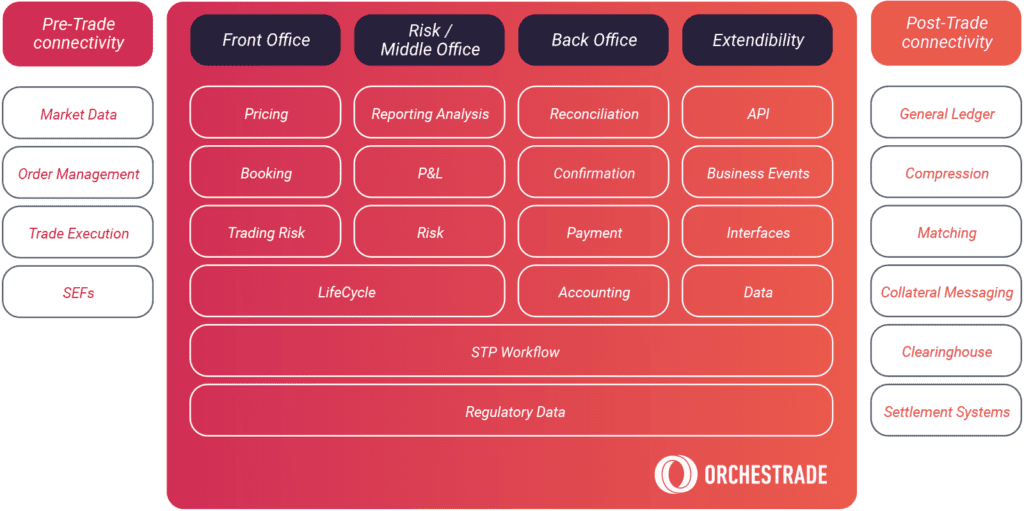

Orchestrade fits with the way you do business.

The modern trading, operations, and risk management platform that is natively cross-asset, business agnostic, and can be adapted at the pace of the market.

Designed for interoperability, it can be a component that extends your existing systems and secures the investment made in your existing IP or a new fully managed environment. Whatever your appetite and needs, Orchestrade is scalable for volume and rapidly extendable to meet market opportunities. We can solve a specific problem at a specific desk or be used across your business, so reducing total cost of ownership.

Orchestrade recognizes the challenges of buy vs build. We provide business and technical flexibility, reduce total cost of ownership over legacy providers and deliver a powerful and adaptive API framework.

Orchestrade delivers, out of the box, the sophisticated capabilities you need but with easy implementation for standard uses. We provide a modernization path for the bank’s legacy architecture

For end users it is an open solution with a highly flexible and intuitive desktop that is easy to learn and quick to set up.

The critical role of technology in a crisis

How can the use of technology that provides transparency, enhances risk management and hedging capabilities, potentially reduce the likelihood of future collapses.

Overview

Lower running costs – consolidating multiple systems into one platform that carries low cost upgrades.

Scalable and extensible - open C# API allows users access to the same interfaces that our developers use to code functionality.

Automated and exception based - complete trade lifecycle is mapped out the instant a trade is booked.

Real-time PnL and powerful risk tools across all asset classes.

Complexity simplified - deep coverage of complex asset classes and ability to quickly add new ones.

Natively cross-asset - Orchestrade is cross-asset by design

Complete lifecycle management of the trading book

Front office

Pricing

Booking

Trading risk

Pre-trade analysis

Risk

Greeks

Scenarios

VAR

Pre-trade compliance

FRTB

Middle office

Real-time PnL

Exception management

Fixing

Trade lifecycle

Confirmation

Reconciliation

Payment

Settlement

Collateral

Accounting

Modern, flexible and highly scalable

Orchestrade is a modern, flexible and highly scalable solution built on the latest technologies.

It is cross-asset by design and offers unrivaled out-of-the-box capabilities with a comprehensive business process library, a range of best-practice workflow configurations and an extensive collection of market standard APIs, all of which enable rapid deployment and a refreshingly short time to value.

Click a + below to discover more

Use Case #1: Risk Aggregation

One of the most significant lessons learned from the last major global financial crisis was that banks’ information technology and data architectures were largely inadequate to support the broad management of financial risks. Many banks lacked the ability to aggregate risk exposures and identify concentrations quickly and accurately at the bank group level, across business lines and between legal entities. Aggregated views of data lacked accuracy and granularity and involved manually intensive processes that were prone to error.

Risk concentrations should be better identified and understood, allowing effective mitigation or diversification strategies. Exposure management should no longer be fragmented, aiding trading efficiency and improving margins. Furthermore, capital markets firms require the introduction of enterprise limits to ensure that trading strategies are aligned with appetite.

- Leverage Orchestrade’s open architecture – draw upon its strengths as a platform for collaboration

- ‘Proof of Concept’ and ‘Best Practice Implementation’ – based upon experience gained at leading banks

- Powerful ‘Out the Box’ capabilities – sensitivities, P&L, Positions, Exposures, Cashflow, etc.

- Full intraday (on demand) reporting – for all risk classes

Use Case #2: Front Office Consolidation

Until recently, low interest rates had reduced margins in transaction banking, so firms looked to open up different lines of revenue. Volatility and uncertainty in the markets has been stifling corporate finance activity. Recessionary pressures are likely to result in some major credit losses, which will inevitably impact earnings. Meanwhile most banks are largely relying on legacy technology solutions which are accompanied by very high fixed costs. The combination of these factors has created a ‘perfect storm’ for sell-side firms in the front office.

Investment banks want to avoid risky, complex software deployments taking many years to install. They also wish to break down the silos wherever possible, consolidating and integrating technology services to reduce maintenance costs and complexity. Greater efficacy of hedging and risk management processes is difficult to achieve with siloed technology.

- Built to collaborate – open, modern, API driven

- Asset class agnostic – deploy across the enterprise

- Event-driven – a better perspective on business than traditional trade-centric systems

- Adaptive workflow – modernize the estate and increase automation

Testimonials

Single View, Global Compliance