Whether you’re a start-up fund or a fund looking to take the next big step, Orchestrade provides the natively cross-asset, cross-instrument, front-to-back portfolio management and risk solution to meet your specialized investment requirements.

Hedge funds have distinct needs:

- Increasing demand for reporting, operational rigor and transparency from regulators and clients.

- Heavy initial and ongoing expenditure on staff and infrastructure combined with the pressure to accelerate the time-to-market

- The right infrastructure in place to raise and support increasing AUM without outpacing infrastructure design and scalability

- Able to cope with significant changes (up/down) in AUM without impacting levels of service

Orchestrade delivers:

- Cost effective turnkey solution with pre-packaged configuration

- Low risk and minimal implementation effort

- Immediate operational pedigree that assists marketing efforts

- Access to sophisticated derivatives technology

- Kept to market by continual evolution of analytical models in response to industry changes

- Full front to back services enables client to quickly achieve scale

- Tried and tested institutional quality infrastructure that can already cope with large AUMs across asset class and instruments

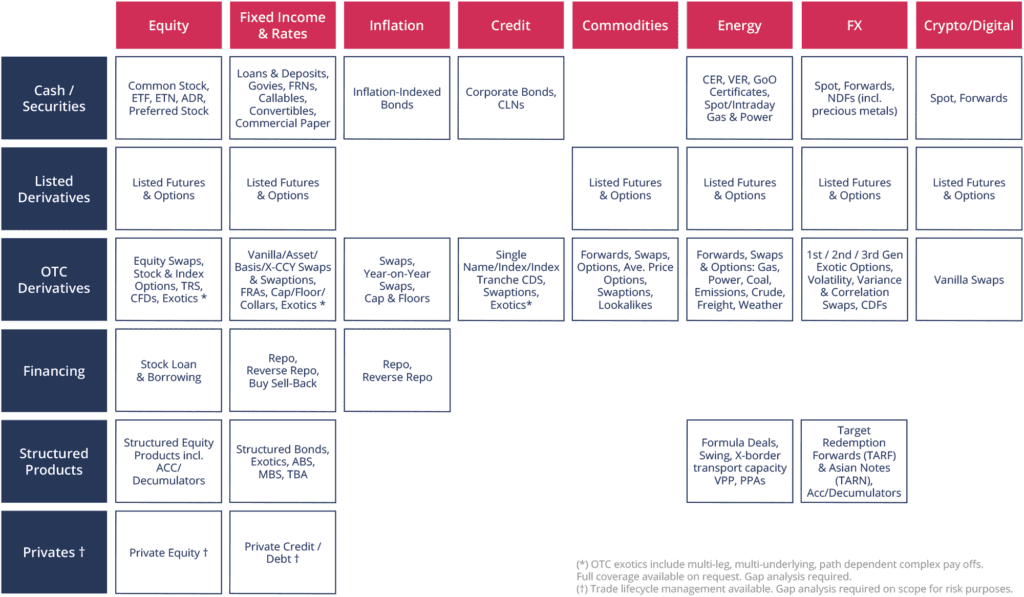

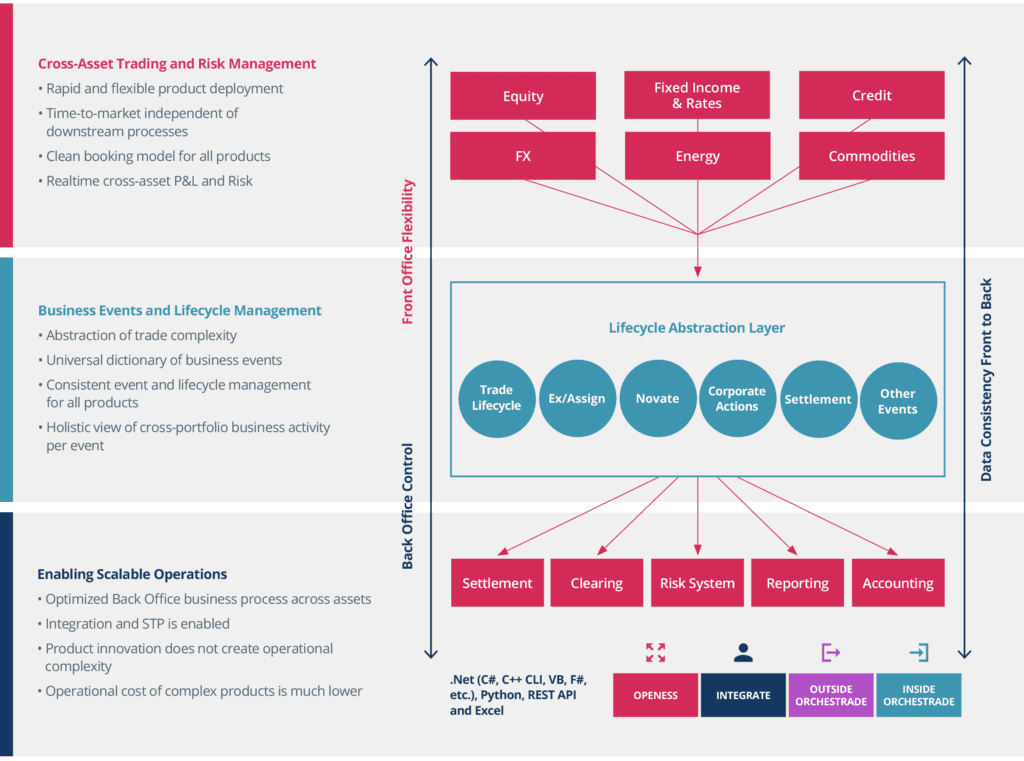

Orchestrade is cross-asset by design and offers unrivalled out-of-the-box capabilities with a comprehensive business process library, a range of best-practice workflow configurations and an extensive collection of market standard APIs, all of which enable rapid deployment and a refreshingly short time to market.

Orchestrade: Single Cross-Asset Data Model

Futureproof your business

Decisions made early in the lifecycle of a hedge fund manager typically have one eye on streamlining costs whilst the performance track record is built, and assets under management grow. However, for many managers that start to approach scale, outgrowing their original choice of platform is an inevitability. They simply require more flexibility to continue growing sustainably. Orchestrade’s portfolio and risk management platform is a natural choice for many given the architectural design and completeness of portfolio management, risk and operational capabilities.

Orchestrade featured in The Hedge Fund Journal

"Hedge fund clients include some giants of the industry, such as three of the largest 15 funds in the US, one of the biggest in Europe and two of the top ten in Asia. Of more than 20 buy side clients, seven run over $15 billion. Taken together, the top five clients manage over $120 billion."

To manage risk, and make effective decisions, traders must have real-time visibility

Overview

Lower running costs - a single system that handles everything out of the box, and is easy to expand to add new business.

Scalable and extensible - open C# API allows users access to the same interfaces that our developers use to code functionality.

Automated and exception based - complete trade lifecycle is mapped out the instant a trade is booked.

Real-time PL and powerful risk tools across all asset classes.

Complexity simplified - deep coverage of complex asset classes and ability to quickly add new ones.

Natively cross-asset - Orchestrade is cross-asset by design.

Cross-Asset Portfolio & Risk Management

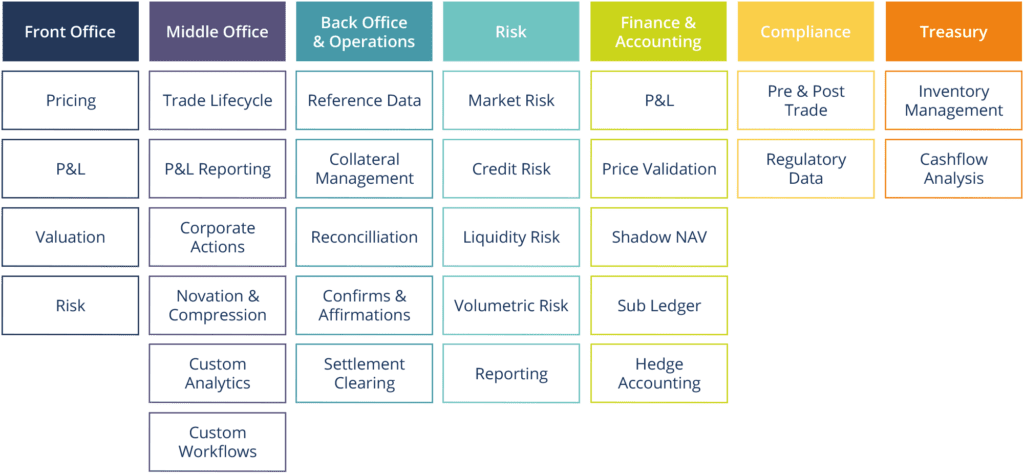

Comprehensive front-to-back functionality

Click a + below to discover more

Users can slice and dice trading activity by fund, strategy, trader, sector, geography, currency and many other factors. Adjustments to the P&L can be explained through identifying movements in rates, currency shifts, changes in equity markets and so on.

What does it mean to be Natively Cross Asset?