We are thrilled to share the news that Orchestrade has won both “Best buy-side portfolio analysis tool” and “Best buy-side corporate actions platform” in the prestigious WatersTechnology Buy-Side Technology Awards 2024.

This is the first time that we have been placed in this celebration of the leading firms in the capital markets technology space.

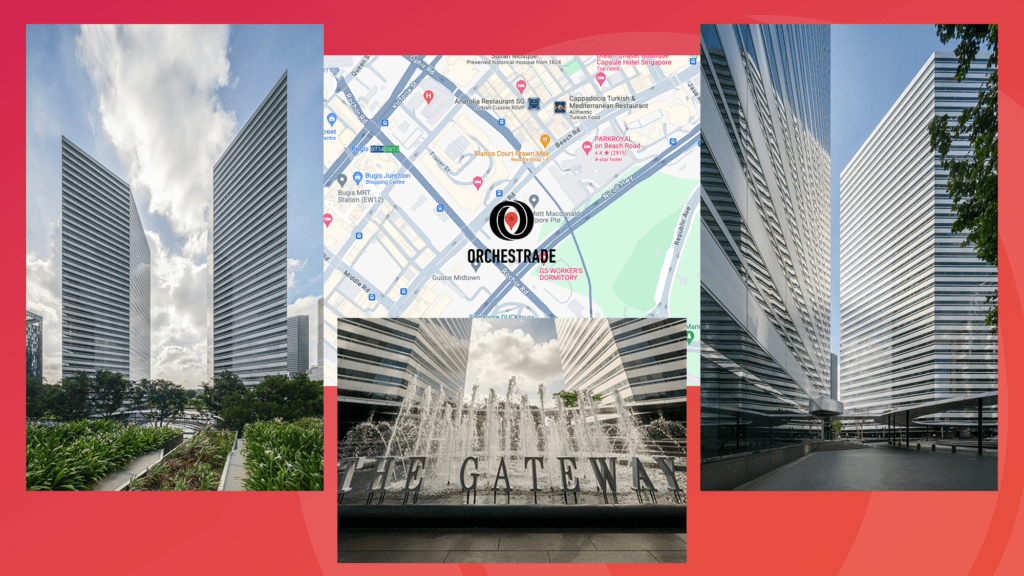

POWERFUL AND SCALABLE TRADING, PORTFOLIO, RISK MANAGEMENT, AND OPERATIONS SOFTWARE

Orchestrade is the award winning, natively cross-asset, front-to-back platform. With unrivalled out-of-the-box capabilities and cloud native deployment to meet the buy-sides specialist requirements.

- PORTFOLIO MANAGEMENT

- REAL-TIME P&L

- RISK MANAGEMENT

- TRADE LIFECYCLE

- ACCOUNTING